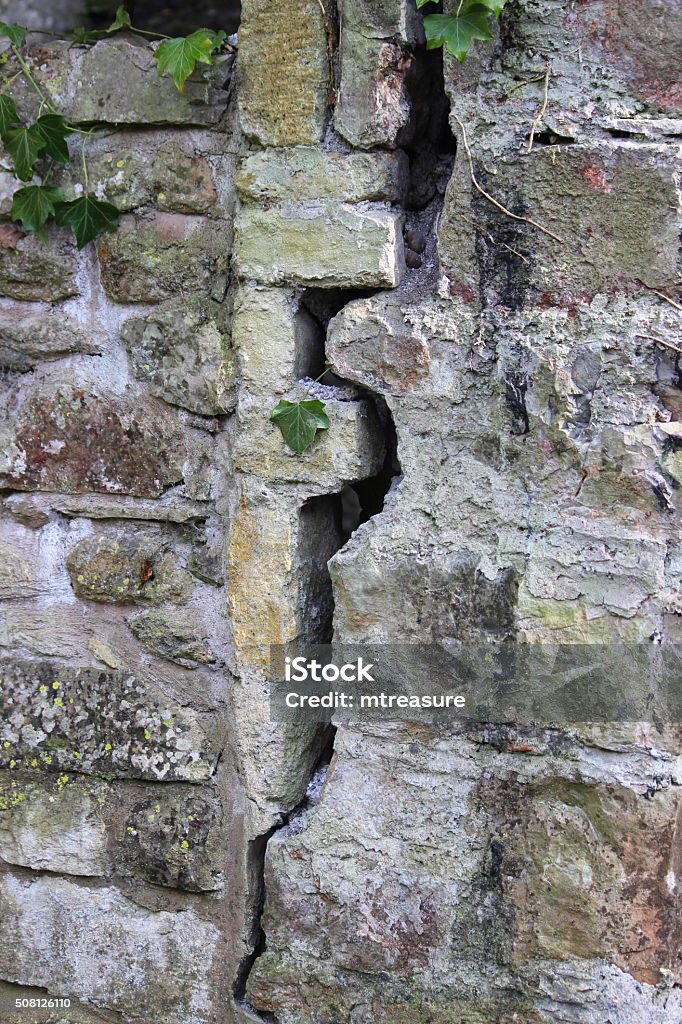

Image Of Rotational Subsidence Cracking House Wall Building Settlement Crack Stock Photo

Buying a house with minor subsidence. If you're considering buying a house with minor subsidence you'll still want to consider it carefully. Even if the subsidence issue isn't particularly serious and it has been fixed, you need to reassure yourself you can get insurance as a priority. And when it comes to sell in the future, you should.

What is subsidence and how can I fix it? My Dream Haus

Every house is different, but as a rough estimate, Priceyourjob.co.uk calculated it would cost £14,000 to fix subsidence in a 3-bed semi-detached house (assuming a single wall required underpinning). The good news though is that most house insurance policies will cover the majority of the cost of repairs.

How to deal with subsidence and structural movement Real Homes

The textbook response to subsidence is to excavate down to stable ground and pump tonnes of concrete into the void. But this is expensive and disruptive, and can actually create problems when applied to old buildings, setting up new stresses between the rigid repaired area and the remaining old walls.

Selling your house suffering with subsidence

The issue of home insurance after subsidence is a big topic in itself, so be sure to educate yourself about it before seeking a new policy. Buying a house with a history of subsidence. Your instinct may well be to avoid a property with a history of subsidence at all costs, and there is some logic to that.

The house with subsidence Derelict Places Urban Exploring Forum

Buying a house with ongoing subsidence is not ideal for most people. But in some cases, the cost of buying the home might be significantly lower than the cost of repairs, making it a good investment for cash buyers. However, remedial work for subsidence is no easy feat, and can often take over a year for the issue to be resolved.

SatSense Detecting House Subsidence Using Satellites and InSAR

That will help make buying a house with minor subsidence no problem. If you cannot get a mortgage from a traditional lender, some specialist lenders or those who offer non-standard mortgages may have more flexibility in considering properties with subsidence problems. However, these lenders often have stricter lending criteria and may charge.

Minor Subsidence When Buying a House

Yes, you may be able to buy a house with subsidence and till take care of it through techniques such as underpinning. Underpinning is where you strengthen the foundations of an entire house. Underpinning can cost as much as £50,000 and some insurance policies may have clauses which cater for any work which needs to be done when subsidence is.

What To Consider Before Buying A House With Subsidence Huuti

23/01/2023 Knowledge Bank Alan Boswell Group. Share: Speak directly to our team. 01603 218000. Make an enquiry. Subsidence can be hard to spot but costly to fix. It can also have a big impact on your home insurance premiums. To help you identify and deal with problems sooner rather than later, here's our guide to subsidence.

What You Need to Know About Subsidence Capital

At John Charcol, we have access to a broad range of mortgages, including exclusive deals and specialist lenders. We can help you find the right product for your circumstances. Get in touch with us today on 0330 433 2927 or submit an online enquiry to find out more.

Subsidence Guide Everything You Need To Know Home selling tips, Home buying tips, Things to come

Minor subsidence is a less severe form of subsidence that can be rectified with proper intervention. When considering buying a house with minor subsidence, it is essential to evaluate the potential risks and costs associated with the property. By obtaining a comprehensive survey, assessing the costs of repair, and considering mortgage.

What to do about subsidence? Parikiaki Cyprus and Cypriot News

3. Buying a house with ongoing subsidence. Buying a house with ongoing subsidence is not for the faint-hearted. If the cost of buying the house and fixing the problem is significantly less than buying a similar problem-free property, it could be a good investment.. BUT, a subsidence issue can take over a year to resolve when you factor in the time waiting on structural reports, gathering.

Buying or selling a house with subsidence things you need to know Raise + Relevel

According to data from the Association of British Insurers, the average insurance claim for subsidence is around £6,250. However, if you ignore it the costs can rise significantly. If your property ends up requiring underpinning, it can end up costing more than £10,000-£50,000 to fix (or even more in some cases).

Buying and selling a house with subsidence Bromley Property Company

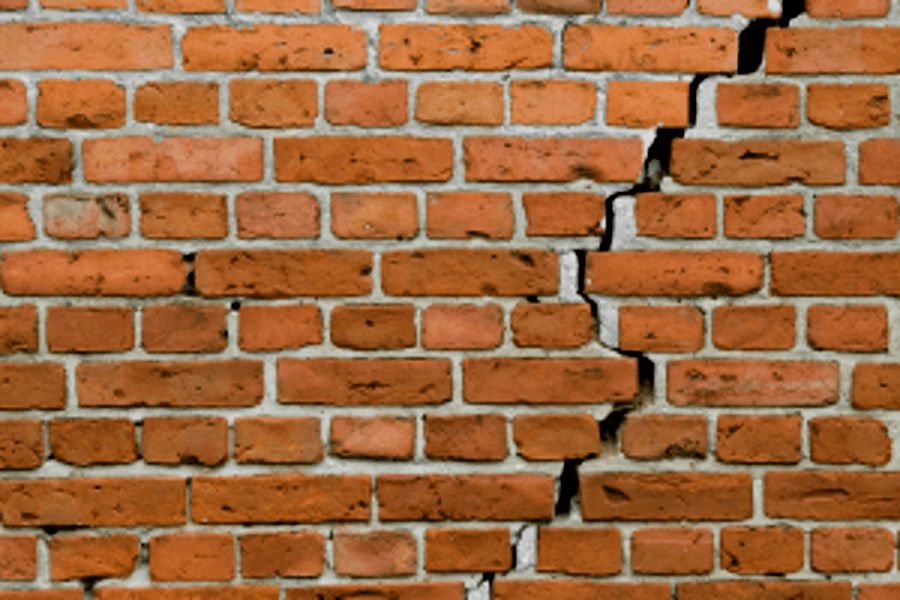

Subsidence causes. Subsidence occurs when the ground on which a property is built shifts for some reason. Perhaps a long dry spell has caused the water table to drop. Perhaps the soil has been disturbed by the roots of trees. Or perhaps a broken drainpipe has caused the soil to be washed away from the foundations. How to spot subsidence.

Selling an underpinned house Can you sell a house with Subsidence? WeBuyAnyHome

Minor subsidence may be addressed relatively cheaply if things haven't progressed too far. Full underpinning will cost in the region of £1,500 - £2,600 per square metre.. but now tends to be used as a last resort for more severe subsidence. Buying an underpinned house should offer reassurance that any previous subsidence issue has been.

Sell a house with subsidence LDN Properties

If no insurer is prepared to offer insurance the £150 fee - minus a small administration charge of £25 plus VAT - will be refunded. Depending on what the inspection found, any insurance.

Sell Your House With Subsidence — SmoothSale

The early warning signs of minor subsidence can involve: Crinkling wallpaper. Cracks near a property extension. Doors and windows becoming harder to open and close, sticking to the frames. Most commonly, small cracks will appear on the inside or outside of the building. Often, if the crack is caused by subsidence, it will be a diagonal crack.